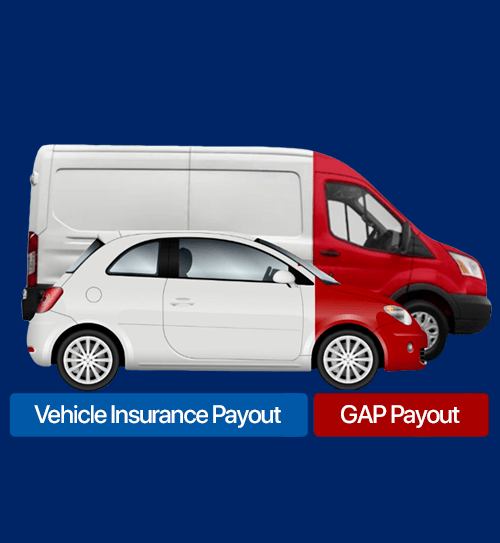

GAP (Guaranteed Asset Protection) Insurance covers the shortfall that can occur following an insurance pay-out for a vehicle that has been written off or stolen, and the remaining amount of finance still owed for the vehicle. Ensuring you aren’t left to pay the remaining finance on a vehicle after it is no longer in your possession.

If your vehicle is written off or stolen, there is a risk that the insurance settlement may be significantly less than the outstanding finance, or even the price you paid for the vehicle.

This is because your insurer will typically only pay the market value of the vehicle at the time of loss, and vehicles lose value quickly in the first year and then at a slower rate as they get older.

We recommend Guaranteed Asset Protection on all new vehicles.

A one off payment will cover your vehicle for the full lease term.

Our GAP insurance is provided by Premia Solutions Limited.

If your vehicle is subject of a Contract Hire agreement then your finance company may also calculate their settlement figure by considering the sum of anything up to 100% of the as yet unpaid rentals under your Contract Hire agreement at the time of loss and Administration & or penalty fees for wrapping up the agreement early.

If you have questions on GAP Insurance please contact our Vehicle Protection Team on 01179625314