The Importance of Customer Service in Van Leasing

Van leasing is a great way to invest in your business. And while we know it’s much more cost-efficient than buying, it’s still […]

August 25th, 2022

We may be called Global Vans, but we can also provide car finance deals!

Taking out vehicle finance involves paying a fixed monthly sum towards the total price of your vehicle. It’s our job to find you the best price on your car, and to find you even better savings by looking for the best finance deal on the market.

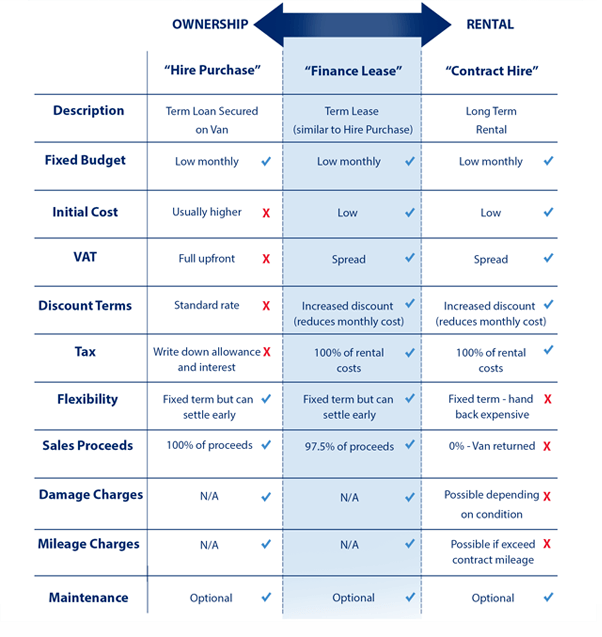

You should ensure that the finance option you choose works for your needs.

Do you want flexibility at the end of your lease? Then you want a finance lease deal.

Don’t want to deal with the hassle of disposal? Maybe contract hire would suit you better.

We can talk through what you need from your car finance deal and help tailor a quote to suit you, whatever your needs.

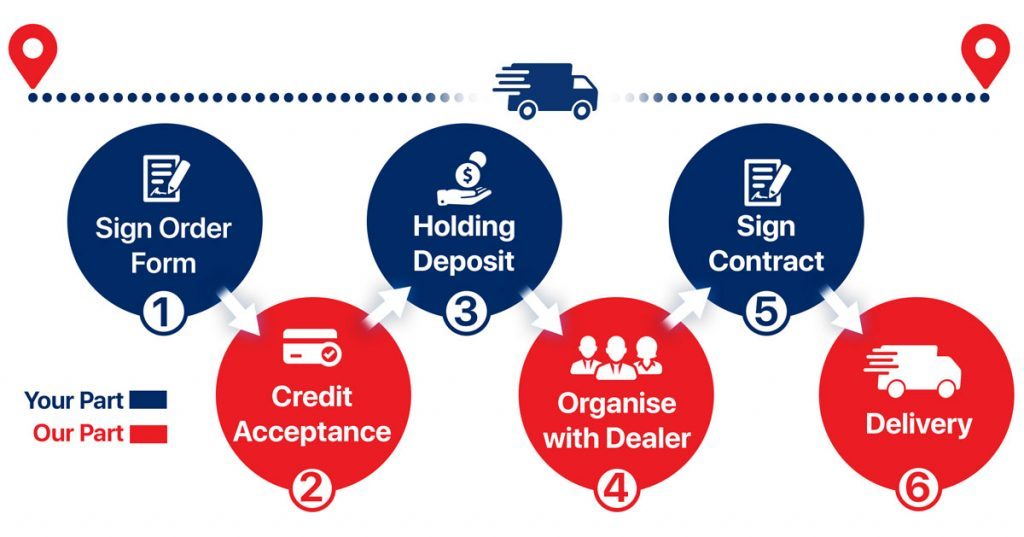

First things first! You’ll speak with one of our leasing specialists, who will tailor a deal to suit you. This will include sourcing you the best price on your car, and finding the funder with the best rate.

Once you’ve decided on your car finance deal, we follow the simple 6-step process below ⬇

Getting a car finance deal is a great way to save money. You’ve ensured you aren’t forking out a huge amount of capital upfront, and you haven’t tied up your funds in a depreciating asset.

There are a few costs to consider when long-term leasing:

If you have further questions about our process or our finance products, or if you’re looking for a car on finance Contact Us or call 01179625314 to speak to one of our leasing specialists.

Van leasing is a great way to invest in your business. And while we know it’s much more cost-efficient than buying, it’s still […]

Looking for a large van lease, but you’re not sure which van to choose? We’ve got you covered. In this article, we’ll walk […]

Whether you’re a window cleaner needing to transport a 1000L tank, or you just need to make sure you can get materials and […]

Leasing a vehicle has lots of benefits for businesses. You’re able to spread the cost of your vehicle across the term of the […]

Commercial pick-ups are versatile, multi-functional vehicles. You can carry heavy loads, tow, and even transport your team. With major manufacturers offering great commercial […]

Finding the right van for you and your business is important. As the best-selling commercial vehicle in the UK the Ford Transit Custom […]

As we all pay more attention to how we are affecting the environment, you may have considered how you can reduce the environmental […]