The Importance of Customer Service in Van Leasing

Van leasing is a great way to invest in your business. And while we know it’s much more cost-efficient than buying, it’s still […]

September 27th, 2019

Trading Style – Sole Traders & Partnerships can have higher score as credit history is often longer. For Limited companies that have not published accounts on companies house you will be typically asked for a higher initial commitment and a director’s guarantee.

Years trading – The longer the better. Note, if you are a limited company and have traded previously as a sole trader or partnership its worth providing how long this was for.

Trading activity – Unfortunately some business sectors have proved to be a higher risk than others. Business such as taxis and same day couriers are higher risk albeit if customer credit history is strong enough it will still be considered.

VAT Registered – This is considered a positive marker.

Your Age – Younger people have a lower chance to build up a credit history profile

Home ownership – Home owners are seen in a positive light.

Time at address – The longer, the better.

Number of address’s in last 4 years – The fewer, the better.

Voters roll – The longer you are on voters roll, the better.

Past experience – If you are a newly started business, your relevant previous experience will help.

Bankruptcy – If you are in or have had any form of bankruptcy IVA or CVA you are highly unlikely to get credit easily. You may be considered once you are out of any arrangement after a number of years of positive credit history.

County Court Judgements – This scores against you, but better if shown as settled and /or some time ago. It also helps to provide some explanation as it’s known for disputes do happen!

Missed Payments – Probably the biggest red flag! But if they exist, often there is a reason which is worth an explanation. Lenders will want to see that payments have been caught up otherwise they may think you can’t afford your commitments. Credit related missed payments will be classed worse than other such as utility bills.

Defaults – This is the result of many non-payments (usually between 3 and 6) to a point where the contract is terminated and the lender / creditor takes the recovery of funds legal. This often ends up with a payment arrangement. This will clearly be very negative and can lead to bankruptcy.

No Credit History – If you have no credit history the finance companies will require additional information to bolster your application. This can be information like bank statements and proof of previous addresses.

Replacement – If the monthly cost is a replacement then this will help your affordability score.

You may be downgraded through association with other people, fraud markers and your address having had bad contracts with people who have previously lived there.

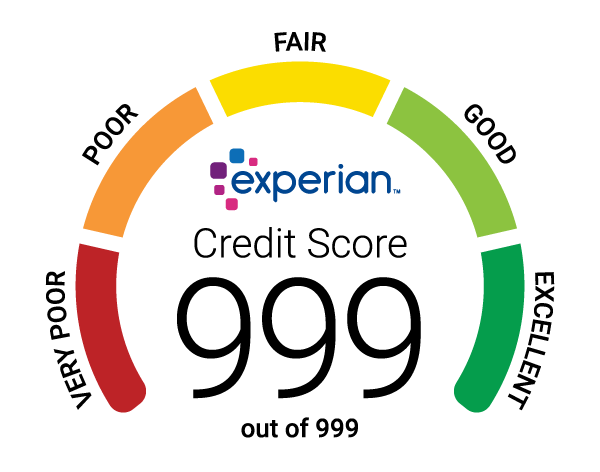

To Check your credit :-

www.equifax.co.uk www.experian.co.uk www.noddle.co.uk

If you think you meet these requirements to lease a vehicle / van then check out our specials, or call us for daily deals on 0117 962 5314.

Van leasing is a great way to invest in your business. And while we know it’s much more cost-efficient than buying, it’s still […]

Looking for a large van lease, but you’re not sure which van to choose? We’ve got you covered. In this article, we’ll walk […]

Whether you’re a window cleaner needing to transport a 1000L tank, or you just need to make sure you can get materials and […]

Leasing a vehicle has lots of benefits for businesses. You’re able to spread the cost of your vehicle across the term of the […]

Commercial pick-ups are versatile, multi-functional vehicles. You can carry heavy loads, tow, and even transport your team. With major manufacturers offering great commercial […]

Finding the right van for you and your business is important. As the best-selling commercial vehicle in the UK the Ford Transit Custom […]

As we all pay more attention to how we are affecting the environment, you may have considered how you can reduce the environmental […]